Starting and running a business can be tough, and with the added stress of keeping up with finances, it can get harder. The financial aspect is one of the most crucial aspects of a business, and if it fails, the business fails. That’s why it’s important to take precautions and protect your business’s finances. In this blog post, we will discuss some tips and tricks on how to do just that – from small business insurance to other measures.

Mixing personal and business finances can be a mistake that many small business owners make. Not only can it create confusion when tax season rolls around, but it can also make it difficult to track business expenses or profits. Opening a separate business bank account or credit card can make things much easier and ensure that you have a clear financial picture of your business.

Unforeseen events can strike any business, and having an emergency fund dedicated to your business can be a game-changer. It will offer you a safety net to cushion the impact of unexpected expenses, such as repairs or sudden drops in revenue. Experts suggest having three to six months of expenses stashed away, but even a modest amount can be helpful. Be prepared and safeguard the future of your business with an emergency fund.

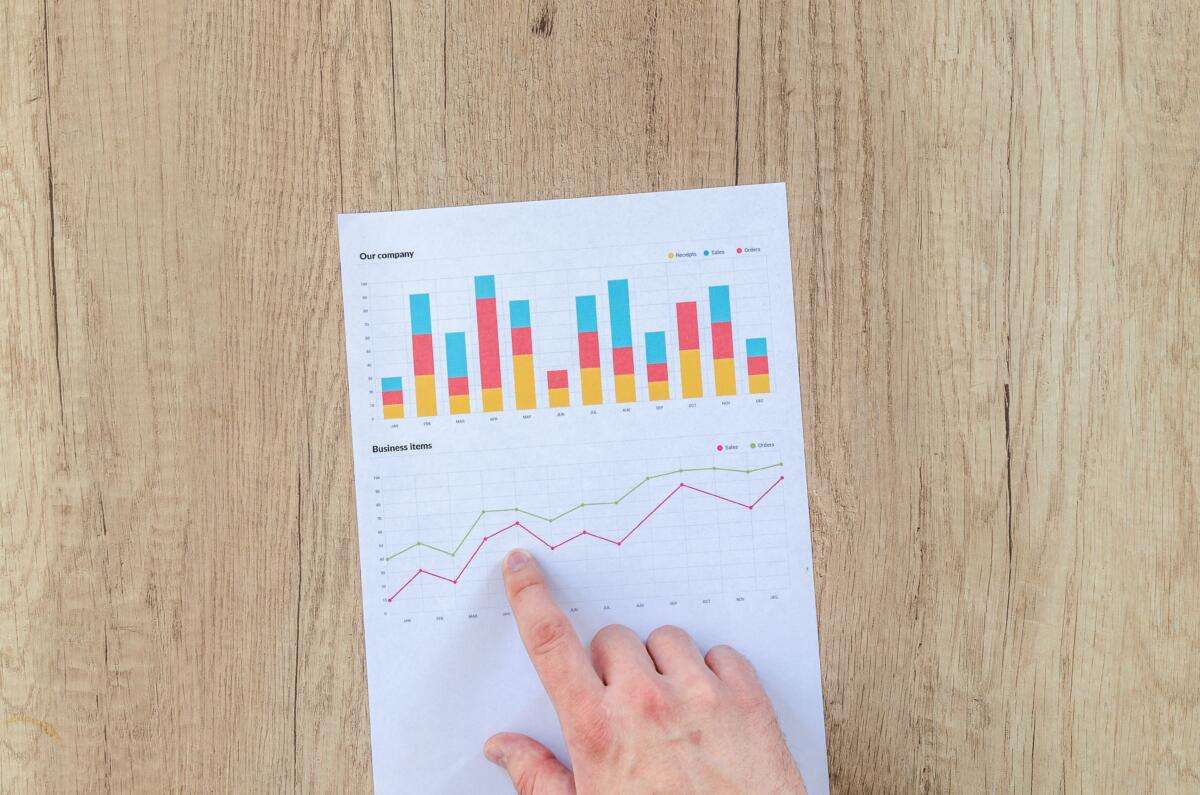

It seems counterintuitive, but one of the best ways to protect your business financially is to use what money you have wisely. A healthy business needs a good cash flow to survive, but what is cash flow?

Cash flow refers to money moving through your business. So yes, your profits are part of your cash flow. But these profits then need to be used to grow and develop your business. It’s useful to have an emergency fund, but the majority of your profits should be funneled back into your company.

The important thing is to spend what you have wisely. If your business has weaknesses, strengthen them. So, if you need to keep up with customer service demands, look into contact center automation to create and manage your call center workforce. This software can help you save time and money and can help you provide a better service to your customers.

Don’t just go for the cheapest option, go for the option that best suits your company.

This is perhaps the most important thing to do when it comes to protecting your business’s financial well-being. With small business insurance, you can protect your business from various risks, such as damage from natural disasters, theft, or lawsuits. It may seem like an added expense, but it is worth it to avoid losing everything in the event of a disaster or lawsuit. If you are struggling to get the right insurance for your business, consider doing an online search for business insurance near me to get the right coverage.

If you’re struggling with high-interest rates on multiple loans or credit cards, there is a solution: consolidate and refinance. By doing so, you can lower your overall payments, freeing up cash for your business. You may also qualify for lower interest rates and payments, making it easier to manage your finances and maintain cash flow. Don’t let high-interest rates hold your business back any longer – take action today and consider consolidating and refinancing.

It’s essential to keep up with invoicing and bill payments to ensure your cash flow is healthy. When invoicing, make sure you’re specific about payment terms and deadlines, and gently follow up with clients who are overdue on payments. Failing to follow up on bill payments can result in late fees or even legal action. It’s also good practice to schedule automatic payments for any recurring bills to avoid missed payments.

Protecting your business financially is crucial to its success. By taking precautions such as small business insurance, separating personal and business finances, building an emergency fund, consolidating or refinancing debt, and keeping up with invoicing and bill payments, you can secure your business’s financial well-being. Remember, a business’s finances can make or break it, so don’t take anything for granted. Take the necessary steps to ensure that your business is protected financially and will be around for years to come.